How Nationwide Defined Protection® Annuity 2.0 works

Protection

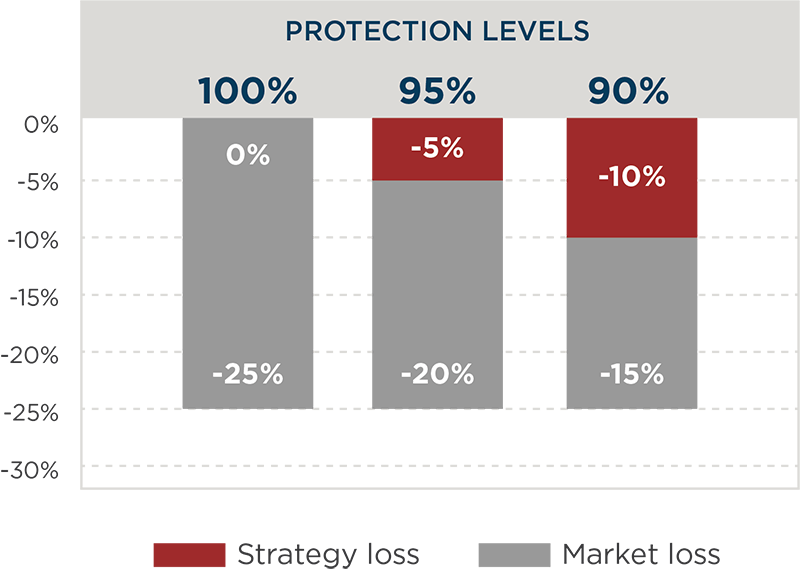

The Protection Level represents the amount of downside protection per Strategy Term. Strategy performance below the Protection Level will not impact the investment. For example, the maximum loss at the end of a Strategy Term with a 95% Protection Level is 5%. Withdrawals in excess of the Free Withdrawal amount may result in losses below the Protection Level. See the Access and Withdrawals section below for more information on Free Withdrawals.

- All three Protection Levels may be available with 1-Year and 3-Year Strategy Terms. Not all Strategies may be available at all times or in all states

- Protection Levels may be adjusted each new Strategy Term if needs change

Note: Protection Levels only apply for the duration of the Strategy Term. Losses over the term of the contract may be greater than the selected Protection Level.

Defined Protection Annuity in Action

See how each Protection Level would have stopped losses at a defined level.

Hypothetical Example based on a 100% Participation Rate in the S&P 500® Price Index from 10/1/07 – 9/30/08. Past performance is not a guarantee of future results. This analysis shows how a Protection Level would be impacted, given the application of the selected scenario, based on historical performance of the S&P 500® Price Index. The hypothetical performance returns are shown for illustrative purposes only and are not intended to be representative of the actual performance returns of any Strategy.

Performance

Defined Protection Annuity offers a variety of traditional and dynamic indices selected to provide diversified growth opportunities. Each Defined Protection Strategy offers a unique combination of Index and Participation Rate.

Participation Rate

The proportion of index growth reflected when calculating any interest earnings. The proportion of Index performance that is reflected in the Strategy Earnings calculation.

Adjust the Crediting Factor

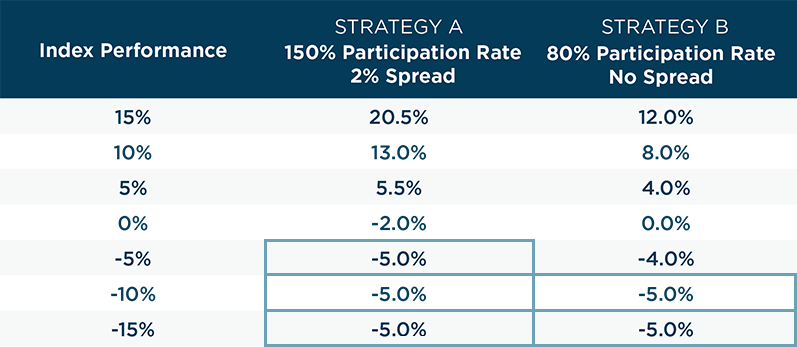

The Participation Rate may increase by selecting a different Strategy Term, lower Protection Level or by selecting a Strategy with a Strategy Spread. A greater Participation Rate increases the impact of Index performance, up or down, not to exceed the Protection Level. The table below shows how selecting a Strategy with a Spread may provide a higher Participation Rate, all other factors being equal:

Hypothetical example provided for informational purposes only. The Strategy Spread cannot move performance below the Protection Level. Past performance is not an indication of future results. Strategies with each crediting factor may not be available. For more information, please consult the Rate Flyer.

Strategy Earnings

The performance of the Index selected, positive or negative, is multiplied by the Participation Rate minus the Strategy Spread when determining earnings at the end of the Strategy Term.

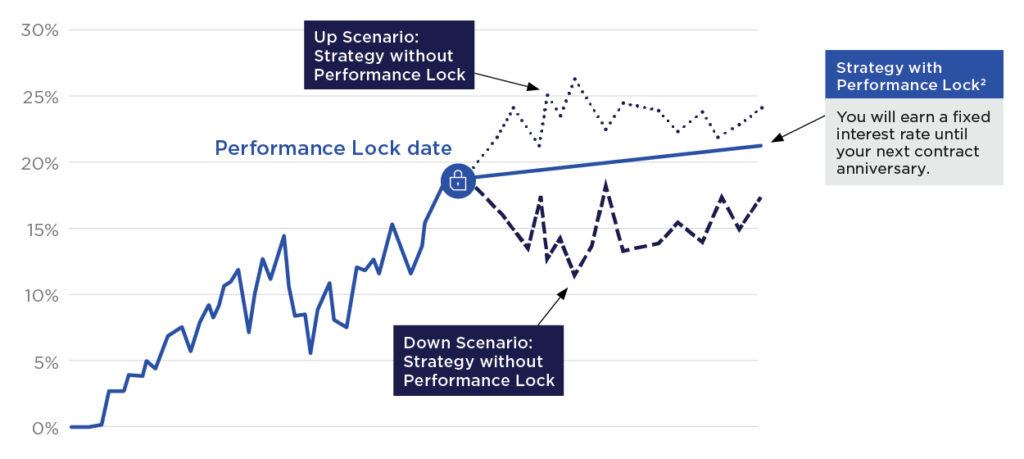

Performance Lock Feature

Once per Strategy Term, on any business day before the term ends, you may lock in the current index strategy value.1,2 Once activated, the index strategy value will move to the Fixed Strategy, where it will earn a fixed interest rate. On your next contract anniversary, you can elect to remain in the fixed strategy for another year or move your assets into any available index strategy.

This hypothetical example is not a projection or prediction of future performance. The performance could be significantly different than the performance shown and shouldn’t be considered a representation of investor experience in the future.

There is no guarantee that exercising a performance lock will result in better strategy performance. Contract owners may miss out on gains that occur after the performance lock or lock in losses that would not have occurred without a performance lock.

Negative Index Performance

Negative Index performance (or the Strategy Spread) will never cause earnings to be less than the Protection Level selected at the beginning of the Strategy Term.

Contract Basics

Contract Value Death Benefit: If either the Annuitant or Co-Annuitant (if applicable) are age 76 or older on the application sign date, the Death Benefit is equal to the Contract Value.

Return of Premium Death Benefit: If the Annuitant and Co-Annuitant (if applicable) are both age 75 or younger on the date the application is signed, the Death Benefit is the ROP Death Benefit. The ROP Death Benefit is equal to the greater of the Contract Value, or the purchase payment amount adjusted proportionately for any withdrawals.

Spousal Protection Feature: This feature protects both spouses, even on qualified contracts. After the first spouse’s death, the surviving spouse may continue the contract and name new beneficiaries. From that point on, any withdrawals will be treated as Free Withdrawals. If the contract contains the Return of Premium Death Benefit, upon the first spouse’s death, the Contract Value will be set equal to the purchase payment amount (adjusted for withdrawals), if greater. Upon the surviving spouse’s death, the Death Benefit (including the ROP if applicable) will be paid to the beneficiaries.

Access and Withdrawals

Free Withdrawals – During the first 6 contract years, you may take a Free Withdrawal of up to 10% of the Contract Value at the beginning of the contract year or the required minimum distribution amount (whichever is greater). Free Withdrawals are also available for long-term care or a terminal illness if certain conditions are met.3

If more than the Free Withdrawal amount is withdrawn before the sixth contract year, a Contingent Deferred Sales Charge (CDSC) may apply.

| Complete Years | 0 | 1 | 2 | 3 | 4 | 5 | 6+ |

| CDSC Percentage | 8% | 8% | 7% | 6% | 5% | 4% | 0% |

Refer to the prospectus for more information on Access and Withdrawals.

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

1 Performance Lock is only available if the strategy return is above the floor resulting from the selected Protection Level.

2 Nationwide will lock in the closing value at the close of business on the New York Stock Exchange on the date the performance lock takes effect.

3 May not be available in all states. Long-term care may be referred to as confinement.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Defined Protection Annuity does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

VAW-0269M1.1 (9/24)