BlackRock

Select Factor Index

Dynamic factor based strategy focused on stability through changing market environments

- Objective – The BlackRock Select Factor Index seeks to generate consistent returns while managing volatility through changing market environments

- Approach – The Index dynamically allocates among five equity style factors each backed by academic evidence. In addition, the Index monitors macroeconomic signals and adjusts positioning according to current economic conditions.

- Holdings – Equity ETFs, Fixed Income ETFs, Cash

- Ticker – BSELFCTX

- Features – Dynamic and diversified multi-factor strategy targets long run returns backed by strong economic rationale.

Helpful Resources

BlackRock Select Factor Index selection process

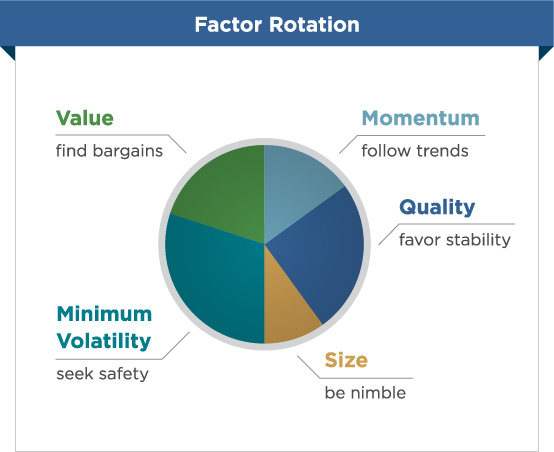

Factor investing is an approach that involves targeting specific drivers of returns across asset classes. Backed by academic research, factor investing can help improve returns, reduce volatility and enhance diversification.

The Index starts with five broadly diversified factor ETFs, identifies the most attractive opportunities based upon the current market environment, valuations and current trends, and then dynamically adjusts exposure.

The Index seeks to partially mitigate broad market risk by hedging broad equity exposure. When economic conditions are volatile, the Index further reduces equity exposure by shifting to bonds. When conditions are favorable, the index shifts back into equities. The Index also allocates to cash to help smooth returns and target 5% volatility.

There can be no guarantee that the BlackRock Select Factor Index approach will meet its objectives.

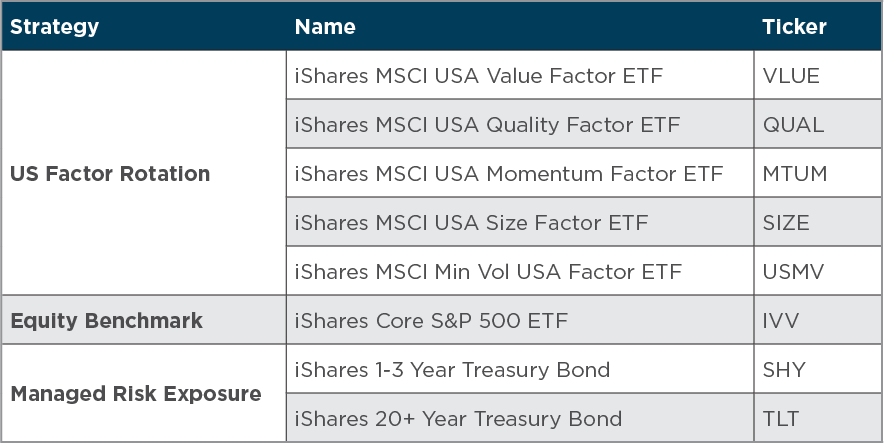

Summary of the investment universe

The equity factor rotation occurs monthly. The broad market equity hedge and bond allocations are determined daily, and allocated to over the next 5 business days. To help maintain the consistent 5% volatility target, the index can also allocate to cash daily.

BlackRock, Inc. is an American multinational investment management corporation based in New York City. Originally, a risk management and fixed income institutional asset manager, BlackRock is now the world’s leading asset manager, with $8.67 trillion in assets under management as of January 2021.

BlackRock is a leader in factor investing, launching the first factor fund in 1971 and has driven innovation in the category for more than 40 years.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read it carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. Please note, the contract does not directly participate in any stock or equity investments. Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

The BlackRock Select Factor Index (“Index”) is a product of BlackRock Index Services, LLC and has been licensed for use by Nationwide Life Insurance Company and Nationwide Life and Annuity Insurance Company (“Licensee”). BlackRock®, BlackRock Select Factor Index and the corresponding logos are registered and unregistered trademarks of BlackRock. This Product is not sponsored, endorsed, sold or promoted by BlackRock Index Services, LLC, BlackRock, Inc., or any of its affiliates, or any of their respective third party licensors (including the Index calculation agent, as applicable) (collectively, “BlackRock”). BlackRock has no obligation or liability in connection with the administration or marketing of this Product. BlackRock makes no representation or warranty, express or implied, to the owners of this Product or any member of the public regarding the advisability of investing in this Product or the ability of the Index to track general market performance. BlackRock does not guarantee the adequacy, accuracy, timeliness, and/or completeness of the Index or any data or communication related thereto nor does it have any liability for any errors, omissions or interruptions of the Index.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company.

© 2022 Nationwide

VAM-3460AO (04/21)